dupage county sales tax rate 2020

Opry Mills Breakfast Restaurants. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption.

Chicago Sales Tax Online 56 Off Www Pegasusaerogroup Com

Majestic Life Church Service Times.

. Even though your tax rate may have decreased the amount of taxes you owe can increase if the taxing bodies ask for more money. The average DuPage tax rate for the 2020 tax season was 73825. The Illinois state sales tax rate is currently.

As of May 20 Dupage County IL shows 4576 tax liens. This is the total of state and county sales tax rates. Dupage County IL currently has 6728 tax liens available as of April 18.

This includes a full list of taxing districts in the county with their tax rates. The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900. Beginning May 2 2022 through September 30 2022 payments may also be mailed to.

County Farm Road Wheaton IL 60187 630-407-6500. DuPage County IL Sales Tax Rate The current total local sales tax rate in DuPage County IL is 7000. Income Tax Rate Indonesia.

The December 2020 total local sales tax rate was also 7000. The Dupage County sales tax rate is. Has impacted many state nexus laws and sales tax collection requirements.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Dupage County IL at tax lien auctions or online distressed asset sales. Dupage County Sales Tax Rate 2020. The 2018 United States Supreme Court decision in South Dakota v.

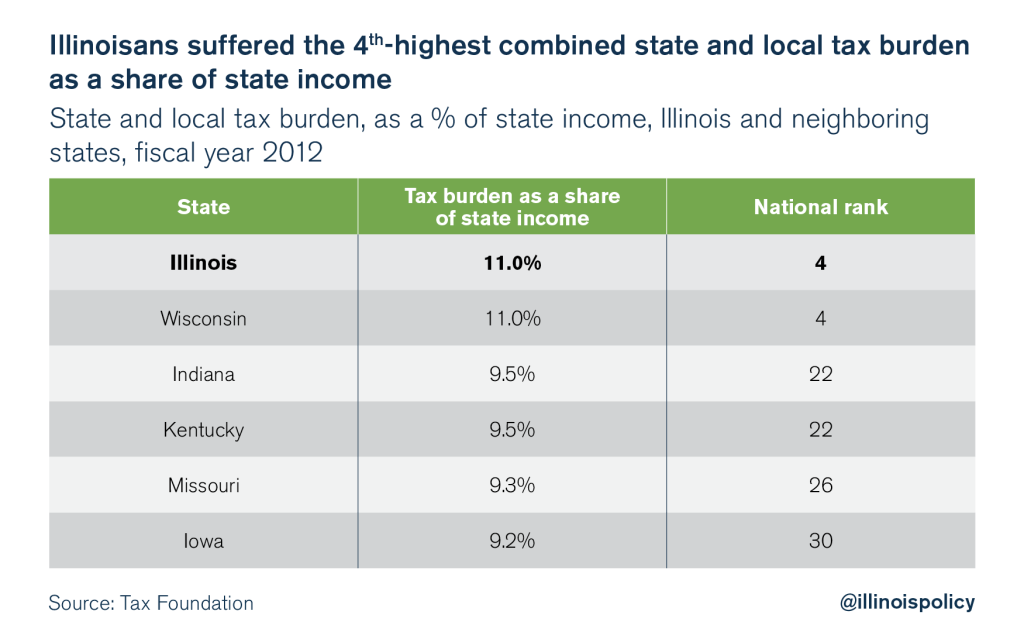

This gives you a property tax of 771840 104550 x 73825 100. These buyers bid for an interest rate on the taxes owed and the right to collect. Illinois has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 475.

There are a total of 495 local tax jurisdictions across the. Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax. If taxes are unpaid you will see a Pay Now button.

The assessed property value for DuPage County is 43052174491 an increase of 38 in 2020. The total sales tax rate in any given location can be broken down into state county city and special district rates. The December 2020 total local sales tax rate was also 8000.

Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425. The base sales tax rate in DuPage County is 7 7 cents per 100. Illinois IL state sales tax rate in DuPage are the lowest in the of.

Dupage County Has No County-Level Sales Tax. The equalization factor currently being assigned is for 2020 taxes payable in 2021. Essex Ct Pizza Restaurants.

While many counties do levy a countywide sales tax Dupage County does not. The Illinois state. The DuPage County Clerk can verify the interest rate on your sold parcel along with the total amount due.

Illinois has a 625 sales tax and Kane County collects an additional NA so the minimum sales tax rate in Kane County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Kane County. 82500. The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900.

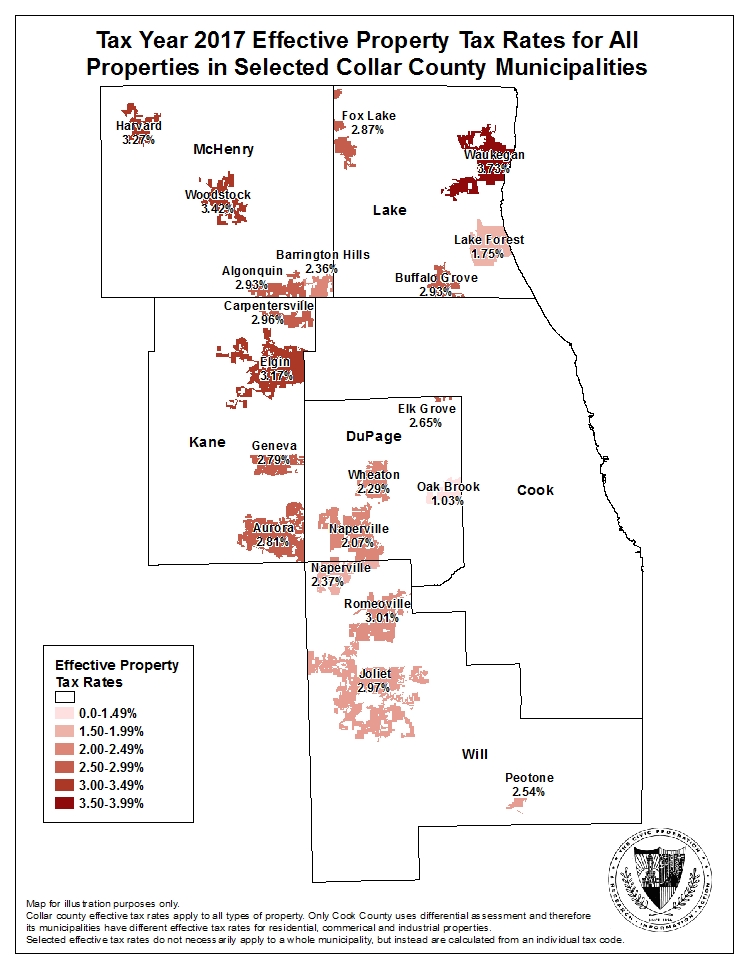

As a note the average successful interest rate bid at the Tax Sale held in November 2020 was 2 per each 6 month redemption period for the majority of parcels Tax Buyers Information about the Annual Tax Sale. County Farm Road Wheaton IL 60187. Assessments in DuPage County are at 3340 percent of market value based on sales of properties in 2017 2018 and 2019.

The Illinois sales tax of 625 applies countywide. Whether food is taxed at the high rate as food prepared for immediate consumption 625 percent or the low rate as food prepared for consumption off the premises where it is sold 1 percent depends upon two. Top Property Taxes Dupage City.

2020 rates included for use while preparing your income tax deduction. DuPage County collects on average 171 of a propertys assessed fair market value as property tax. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N.

Dupage county sales tax rate 2020 Tuesday March 15 2022 Edit. Restaurants In Matthews Nc That Deliver. Average Sales Tax With Local.

Soldier For Life Fort Campbell. The December 2020 total local sales tax rate was also 8000. 1337 rows 2022 List of Illinois Local Sales Tax Rates.

As I write this letter I understand that the average tax rate is down 62 with the average tax bill up 318. Last years equalization factor for the county was 10000. The December 2020 total local sales tax rate was also 7000.

Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate in Cook County is 8 not including any city or special district taxes. Click on the Pay Now button and follow instructions. DuPage County has one of the highest median property taxes in the United States and is ranked 27th of the 3143 counties in.

You have up to the day immediately before the sale to pay all delinquent taxes and. The minimum combined 2022 sales tax rate for Dupage County Illinois is. Interested in a tax lien in.

Heres how Dupage Countys maximum sales tax rate of 105 compares to other. 2020 DuPage County Tax Rate Booklet. 2 2 2 2 Village Of Roselle What Is Illinois Car Sales Tax 485bpos 1 Tebf485b Htm The Tax Exempt Bond Fund Of America Sec 1 Difference Between Tax Liens And Tax Deeds Free Course 2 Download Instructions For Form St 556 Sales Tax Transaction Return For Leasing Companies Selling At.

Box 4203 Carol Stream IL 60197-4203. The base sales tax rate in DuPage County is 7 7 cents per 100. DuPage County Collector PO.

Chicago Sales Tax Online 56 Off Www Pegasusaerogroup Com

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Chicago Il Property Tax Rate On Sale 50 Off Www Pegasusaerogroup Com

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

California S Highest In The Nation Gas And Diesel Taxes California Globe

Chicago Sales Tax Online 56 Off Www Pegasusaerogroup Com

Property Tax Village Of Carol Stream Il

Sales Tax Village Of Carol Stream Il

How To Calculate Sales Tax Definition Formula Example

What Is Illinois Sales Tax Discover The Illinois Sales Tax Rates For 102 Counties

Chicago Sales Tax Online 56 Off Www Pegasusaerogroup Com

Chicago Sales Tax Online 56 Off Www Pegasusaerogroup Com

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Illinois Sales Use Tax Guide Avalara

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

North Central Illinois Economic Development Corporation Property Taxes

Illinois Car Sales Tax Countryside Autobarn Volkswagen